Thursday, April 29, 2021

A strong state economic recovery appears well underway, |

|

Federal aid and rising vaccination levels boost state and national growth rates & income levels |

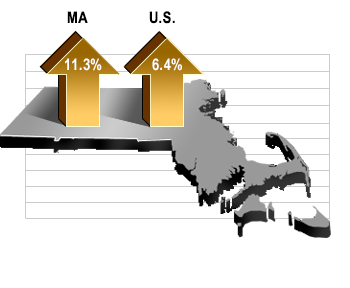

In the first quarter of 2021, Massachusetts real gross domestic product (GDP) increased at a 11.3 percent annualized rate of growth, according to MassBenchmarks, while U.S. GDP increased at a 6.4 percent rate according to the U.S. Bureau of Economic Analysis (BEA). In the fourth quarter of last year, the Massachusetts economy expanded at a 4.7 percent rate while U.S. GDP increased at a 4.3 percent rate according to the BEA.

"Economic growth in both the state and the nation in the first quarter exceeded expectations for two reasons," noted Alan Clayton-Matthews, MassBenchmarks Senior Contributing Editor and Professor Emeritus of Economics and Public Policy at Northeastern University, who compiles and analyzes the Current and Leading Indexes. "The first is due to the sheer size of the recent federal coronavirus relief package which had an immediate effect on household income and consumer expectations and the second was the faster than expected distribution of COVID-19 vaccines," Clayton-Matthews added. The Commonwealth is well positioned for a stronger rebound than the nation in part because its shutdown last year at this time was broader and accompanied by larger employment losses than in most states. That potential was partly realized in the first quarter when Massachusetts experienced stronger employment and earnings growth and a faster fall in unemployment rates than the U.S.

Payroll employment in Massachusetts grew at a 6.8 percent annual rate in the first quarter, over three times as fast as the 2.1 percent rate nationally. In the fourth quarter of 2020 employment also grew faster than in the nation, at a 6.6 percent rate for Massachusetts and 5.1 percent nationally. Despite this strong growth, payroll employment in Massachusetts in the first quarter of 2020 remained 8.3 percent below the first quarter of 2020, while the U.S. jobs deficit was 5.6 percent for the U.S on a year-over-year basis.

Aggregate wage and salary growth in Massachusetts during the first quarter was very strong, expanding at a 25.7 percent annual rate. This estimate is based on state withholding taxes net of unemployment insurance withholding. The corresponding estimate for the U.S. estimates national wage and salary growth of 6.6 percent. The strong showing in Massachusetts may in part reflect a good bonus season. The S&P stock index finished 2020 16.3 percent larger than it started.

Wage and salary income in the first quarter exceeded that of the first quarter 2020 by 6.5 percent in Massachusetts and 1.8 percent in the U.S. The contrast between the return of workers' income to pre-pandemic levels while employment continues to recover is the result of job losses. Low-wage sectors such as leisure and hospitality and personal services were hit the hardest in the shutdown and remain the sectors furthest from their pre-pandemic employment levels.

The unemployment rate for Massachusetts in March remained higher than for the U.S. — 6.8 percent versus 6.0 percent — but it fell faster during the first quarter, from 8.4 percent in December in Massachusetts and 6.7 percent for the U.S. This is unsurprising in light of the faster job growth in Massachusetts during this time.

The U-6 unemployment rate in March — which includes persons working part-time but who want full-time work and persons who want work but have not looked for work in the last four weeks (the marginally attached) — was 9.4 percent in Massachusetts and 10.7 percent for the U.S. These rates are significantly lower than in December, but still are well above pre-pandemic levels. The number of marginally attached unemployed remains at levels experienced during the Great Recession (2008/2009) and may include persons who intend to re-enter the regular labor force once they are convinced it is safe to return to work and/or after schools and childcare options fully return to normal operations.

Spending in Massachusetts on items subject to the regular sales and motor vehicle sales taxes grew robustly in the first quarter, at an annual rate of 39.2 percent after growing by 2.8 percent in the fourth quarter of last year. Relative to the first quarter of 2020, this spending is up 13.1 percent and is consistent with strong growth in durable goods spending at the national level.

Growth is expected to remain strong through the spring and summer months, with Massachusetts real gross domestic product projected to rise at 7.5 percent annual rate in the second quarter and 8.5 percent in the third quarter of this year. Significant threats to the state's economic outlook include unexpected delays or disruptions to the pace at which the population becomes vaccinated, the unforeseen emergence of vaccine-resistant viral variants, and supply bottlenecks due to supply chain disruptions or labor shortages domestically and internationally. The strong U.S. economy may be lifting global growth, but if the slow pace of vaccinations in much of the world persists, it can be expected to serve as a constraint on growth in the U.S. going forward.

| ADDITIONAL RESOURCES |

|

|

A comprehensive analysis of the state of the Massachusetts economy can be found in the most recent issue of MassBenchmarks. |

|

MassBenchmarks is published by the University of Massachusetts Donahue Institute in cooperation with the Federal Reserve Bank of Boston. The Donahue Institute is the public service, outreach, and economic development unit of the University of Massachusetts. The Current and Leading Indexes are compiled and analyzed by Dr. Alan Clayton-Matthews, Professor Emeritus of Economics & Public Policy at Northeastern University and released quarterly by MassBenchmarks.

![]()

For more information please contact:

|

|

|||

|

|

|

||

![]()

![]()